Labels for Safety, Visuals and Facility ID Desktop Printers

Labels for Product, Wire and Lab ID Benchtop Printers

Labels for Safety, Visuals and Facility ID Desktop Printers

Labels for Product, Wire and Lab ID Benchtop Printers

Safety and Facility ID Desktop Printers

Product, Wire & Lab ID Desktop Printers

General Purpose Barcode Scanner & Accessories

Barcode Scanner and Printer Kits

PaintStripe Floor Marking Stencils

Valve Lockouts & Hose Lockouts

Group Lock Boxes & Permit Control

Pipe Marker Accessories & Mounting Brackets

Maintenance and Production Tags

Calculators and Assessment Tools

Product Finders and Data Sheets

Workplace Safety & Efficiency Topics

You must provide a valid tax exempt certificate for your "Ship To" address to avoid sales taxes.

If you have previously provided tax exemption certificates to Brady, you can apply them to your online order. You will need a Bradyid.com website account to leverage your exemptions.

If you have a BradyID.com account already, just login to your account and your tax exemptions will be applied if we have one for your “Ship To” address. You can view the tax exemptions you have on file with Brady by going to the “My Account” section of Bradyid.com.

Create an account by choosing “Sign In” from the website header and follow the prompts. We’ll attempt to link your new online account with your company account with Brady. You will then be able to see your on-file tax exemptions in the “My Account” section of Bradyid.com. NOTE: If you don’t see your tax exemptions immediately you can place your order but tax will be applied. You’ll need then, to contact Brady customer service to have tax removed or a credit issued for orders that have already been invoiced.

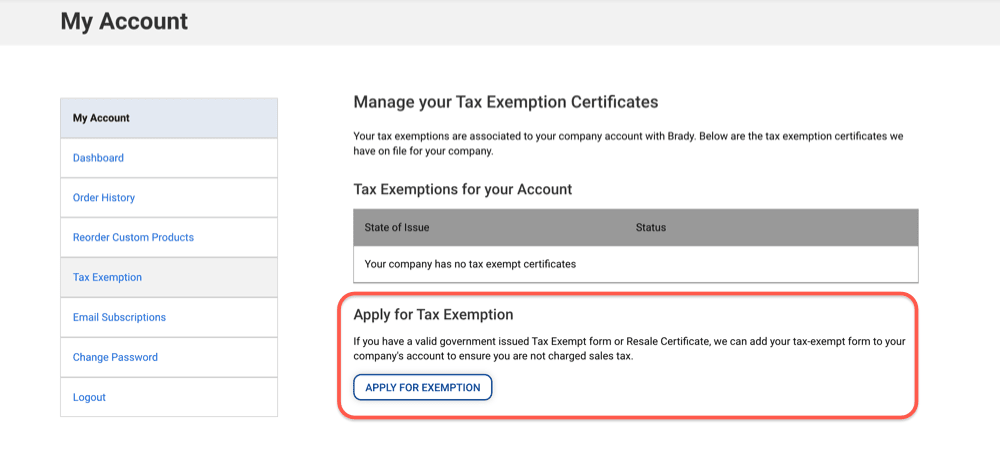

To apply for an exemption, you will need to provide an appropriate tax exemption certificate. This can be done when you are placing an order or, for customers with Bradyid.com accounts, anytime from the “My Account” section of the website.

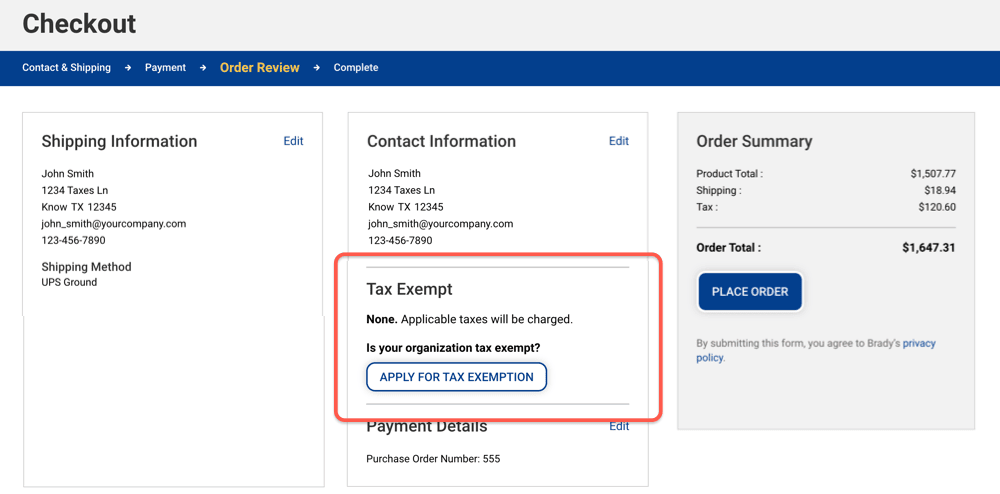

Proceed through the checkout page until you reach the order review page. There you will see a section related to taxes for your order.

Click the “Apply for tax exemption” button and follow the prompts. You will have two options:

With each option, we’ll charge taxes with the order but wait to invoice you until your tax exemption request has been approved. If your tax exemption request is declined or your information is received too late (we won’t hold up shipping your order), you will be charged tax. You can still contact Brady customer service, if necessary, to have a credit issued.

Registered users can also apply for tax exemption from the “My Account” section of the website at any time. You may want to do this if you know you will be placing future orders and want to avoid any delays or misapplied taxes. The process for apply from the “My Account” section is the same as in checkout.

For further assistance, contact Brady Customer Service and we’ll be happy to help.

Important Notes:

A W-9 is not an acceptable form of exemption.

A Federal Government customer is not required to submit any documentation.

A Contractor must provide a Contractor Exempt Purchase Certificate for each unique purchase order.

An Export Declaration or Bill-of Lading must be provided to exempt any international orders shipping to freight forwarders.

References

A) State Form - An exemption certificate issued by state you are incorporated or headquarters.

B) Uniform - Multijurisdictional Uniform Sales & Use Tax Exemption/Resale Certificate Tax form.

C) Streamlined - Streamlined Sales and Use Tax Agreement) form.

D) If shipping to these States, you must be registered in the State you are shipping goods in order to be exempt. If you are not registered, you can provide us with your end customer's tax exemption certificate to exempt to exempt the order.

E) If shipping to these States, you must be registered in the State in order to be tax exempt.

| Ship-To State | State Form A | Uniform Certificate B | Streamlined C | Acceptable State Forms |

|---|---|---|---|---|

| Alabama | X | X | Statement Letter | |

| Arkansas | X | X | X | Form ST-391 |

| Arizona | X | X | Form 5000A | |

| California D | X | X | CDTFA-230 | |

| Colorado | X | X | DR-0563 MJ Form | |

| Connecticut E | X | X | CT Resale Certificate, Cert 119, or Cert 13 | |

| Washington DC E | X | OTR-368 Form | ||

| Florida | X | X | State-Issued Form DR-13 or DR-14 | |

| Georgia | X | X | X | GA Form ST-4 or ST-5 |

| Hawaii E | X | X | Form G-17, G-18, or G-19 | |

| Idaho | X | X | Form ST-101 | |

| Illnois D | X | X | Form CRT-61 | |

| Indiana | X | X | Form ST-105 | |

| Iowa | X | X | X | Form 31-014b |

| Kansas | X | X | X | Form ST-28A for PR-78SSTA |

| Kentucky | X | X | X | Form 51A105 or 51A126 |

| Louisiana | X | Form R-1064, R-1042, R-1056, or R-1356 | ||

| Maine | X | X | Maine Resale Certificate | |

| Maryland E | X | X | Maryland Sales & Use Tax Licen | |

| Massachusetts D | X | Form ST-2, ST-4, or ST-5 | ||

| Michigan | X | X | X | Form 3372 |

| Minnesota | X | X | X | Form ST-3 |

| Mississippi D | X | MS Retailer's Permit | ||

| Missouri | X | X | Form 149 | |

| Nebraska | X | X | X | Form 13 |

| New Jersey | X | X | X | Form ST-3, ST-3NR, or ST-5 |

| New Mexico | X | X | Type 2-NTTC, Type 5-NTTC, or Type 9-NTTC | |

| Nevada | X | X | X | State-Issued Exemption Letter |

| New York | X | X | X | Form ST-119 or ST-120 |

| North Carolina | X | X | X | Form E-590 or 595E |

| North Dakota | X | X | Form SFN 21950 | |

| Ohio | X | X | X | Form STEC U |

| Oklahoma | X | X | X | OK Permit or State-Issued Exemption Certificate |

| Pennsylvania | X | X | Form REV-1220 | |

| Puerto Rico E | X | Form AS 2916.1 | ||

| Rhode Island | X | X | X | RI Resale Certificate |

| South Carolina | X | X | Form ST-8A or ST-9 | |

| South Dakota | X | X | X | Form RV-066 |

| Tennessee D | X | X | RV-F1300701 Blanket Certificate of Resale | |

| Texas | X | X | Form 01-339 | |

| Utah | X | X | X | Form TC-721 |

| Vermont | X | X | X | Form S-3 |

| Virginia | X | Form ST-10, ST-12, ST-13A, or ST-14 | ||

| Washington | X | X | X | WA Reseller Permit |

| West Virginia | X | Form F0003 Streamlined Certificate of Exemption | ||

| Wisconsin | X | X | X | Form S-211 |

| Wyoming | X | Form F0003 Streamlined Certificate of Exemption |

If you need to cancel your order for any reason please contact Brady customer service at 1-888-250-3082. Due to the frequency in which orders are fulfilled and the volume in which orders are placed, Brady cannot guarantee any cancellation requests.